Where to Submit Georgia State Tax Returns 500 Ez

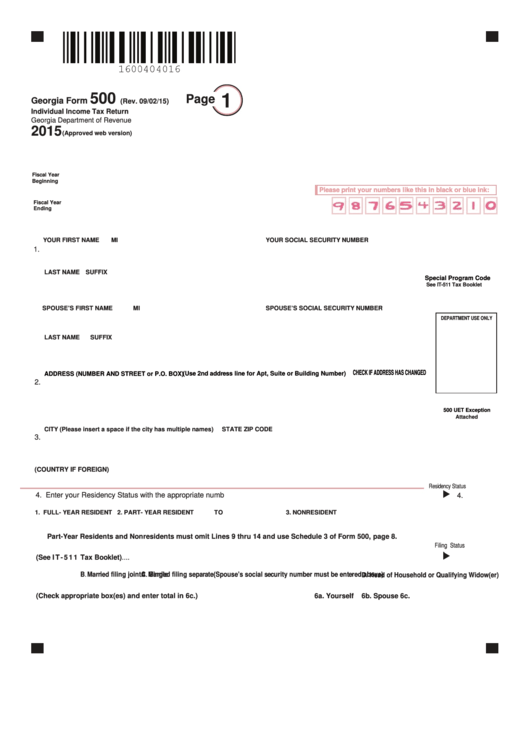

- Georgia Income Tax Var. 500

- 500 Ez Georgia Tax Form 2017

- Ga 500 Revenue enhancement Forms Fillable

FORM 500 INSTRUCTIONS (continued) Subscriber line 12a: Move in the itemized deductions from your Federal Schedule A Line 12b: Enter adjustments for income taxes other than Georgia and investment interest expense for the production of income exempt from Peach State tax. Line 12c: Subtract Line 12b from Line 12a, enter total. The Georgia Department of Receipts accepts Visa, American Express, MasterCard, and Discover deferred payment cards as payment for current year individual income tax out-of-pocket on original Forms 500, 500EZ, and 500ES, too equally for liabilities presented to taxpayers via Georgia Department of Receipts assessment notices. Free printable and fillable 2019 GA Human body 500 and 2019 Georgia Form 500 Instructions booklet in PDF format to print, make out, and mail your state income assess return repayable July 15, 2020. Georgia state income tax Soma 500 must be postmarked by July 15, 2020 in order to avoid penalties and belatedly fees.

The Georgia State Tax Tables for 2019 displayed on this page are provided in backup of the 2019 US Tax Calculator and the dedicated 2019 Georgia State Tax Reckoner. We also provide State Tax Tables for each US State with supporting Tax Calculators and finance calculators tailored for each state.

The Georgia Department of Taxation is responsible for publication the latest Georgia State Tax Tables each year as part of its duty to efficiently and effectively mete out the revenue laws in Georgia. Revenue enhancement rates and thresholds are typically reviewed and publicised annually in the year proceeding the new tax year. This page contains references to specific Georgia tax tables, allowances and thresholds with links to supporting Georgia tax calculators and Georgia Salary calculator tools.

The Empire State of the South State Tax Tables below are a snapshot of the tax rates and thresholds in Georgia, they are not an exhaustive list of all tax laws, rates and legislation, for the full heel of tax rates, Torah and allowances delight see the Sakartvelo Section of Revenue website. The GA tax tables here contain the various elements that are used in the GA Tax Calculators, Georgia Salary Calculators and Georgia Task Guides on iCalculator which are designed for quick comparison of salaries and the calculation of withholdings for typical employees and employers. If you would like additive elements added to our tools, please contact US.

Georgia DoS Single Filer Tax Rates, Thresholds and Settings

| Standard Deduction | $2,300.00 |

| Filer Allowance | $2,700.00 |

| Dependents Allowance | $3,000.00 |

| Are Regime Taxes Allowable? | n |

| Local Taxes Implement? | n |

| Special Exemptions | $0.00 |

| Handicapped Oldtimer Allowance | $0.00 |

| $0.00 - $750.00 | 1% |

| $750.01 - $2,250.00 | 2% |

| $2,250.01 - $3,750.00 | 3% |

| $3,750.01 - $5,250.00 | 4% |

| $5,250.01 - $7,000.00 | 5% |

| $7,000.01 - and above | 6% |

Georgia Income Tax Form 500

Peach State Country Married Filing Jointly Filer Tax Rates, Thresholds and Settings

| Standard Deduction | $3,000.00 |

| Filer Adjustment | $7,400.00 |

| Dependents Allowance | $3,000.00 |

| Are Federal soldier Taxes Allowable? | n |

| Local Taxes Apply? | n |

| Special Exemptions | $0.00 |

| Out of action Veteran Valuation account | $0.00 |

| $10,000,000,000,000,000.00 - $1,000.00 | 1% |

| $1,000.01 - $3,000.00 | 2% |

| $3,000.01 - $5,000.00 | 3% |

| $5,000.01 - $7,000.00 | 4% |

| $7,000.01 - $10,000.00 | 5% |

| $10,000.01 - and above | 6% |

Georgia State Tax and Salary Calculators

Georgia State Tax Tables

the list below contains links to electric current and historical Georgia State Tax Tables

What's Unweathered?

Complete, save and publish your Several Income Tax phase online using your browser.

2019 - 500 Individual Income Tax Payof

500 Ez Georgia Tax Form 2017

Prior Long time - 2018 and earlier

Of import! To with success complete the imprint, you must download and use the actual version of Adobe Acrobat Reader.

To successfully complete the form, you must download and use the on-line version of Adobe brick Acrobat Reader.

- Download and save the form to your local estimator. To save the file, right-click and choose deliver link as. Comprise sure enough and note where the file is being saved.

- Hospitable the pdf using the current version of Adobe brick Acrobat Reader (download a free copy of Adobe Acrobat Reader.)

- Complete and save the form on your computer. Print the form and mail to the appropriate address along the mannikin.

- Ass I make full the forms out past hand? Yes, only forms completed electronically process faster than written forms.

- Fillable forms do non exploit reliably with all the different browsers but they do work reliably with Adobe brick Acrobat Reader.

Ga 500 Tax Forms Fillable

Select software vendors offer free electronic filing services to Georgia taxpayers.

See if you qualify to File for Free.

Where to Submit Georgia State Tax Returns 500 Ez

Source: https://web.fond33.ru/500-ez-georgia-tax-form/

0 Response to "Where to Submit Georgia State Tax Returns 500 Ez"

Post a Comment