what is the relation of gold prices to real interest rate

Involvement rates quoted in the markets are nominal, and then ane typically has to adjust them for inflation. Inflation determines the difference betwixt nominal and real involvement rates. Nominal involvement rates represent rates before taking inflation into account, while real rates are nominal rates adjusted for aggrandizement. Equally there are several inflation indices (and many maturities), there are many measures of real interest rates. Nevertheless, analysts often utilize yields on Treasury Inflation Protected Securities (TIPS), which are indexed to inflation (CPI) and their par value rises with aggrandizement, as a proxy for real interest rates. Investors should remember that real interest rates are much more of import for the gold market place than changes in nominal interest rates, including the federal funds rate.

Real Interest Rates and Gold

More often than not, existent interest rates are negatively correlated with the price of golden, i.eastward. rising real rates adversely bear upon the yellow metallic. For case, in the article entitled The Golden Dilemma, Claude Erb and Campbell Harvey institute very potent negative correlation between real interest rates and golden prices (from 1997 to 2012), to the tune of -0.82 (while -1 means a perfect negative correlation). The reasoning behind this is that higher interest rates hateful higher opportunity costs of holding not-interest bearing assets, such as precious metals, making them relatively less attractive. Basically, gold pays neither dividends nor involvement. Thus, it is relatively expensive to hold in the portfolio when existent involvement rates are high, and relatively cheap when real interest rates are depression. In other words, the higher the involvement rates are, the college are carrying costs.

Withal, the human relationship is not linear. Gold prices tend to increase significantly only during the periods of negative real involvement rates. This is because negative interest rates, i.eastward. the situation when the inflation rate is higher than the nominal interest rate (the charge per unit which is really paid), ways that creditors are losing money, therefore they are more decumbent to buy gilded, fifty-fifty though information technology does not acquit interest or dividends. In other words, gold and so reclaims its traditional function as money and a store of wealth, which will at least keep pace with inflation to preserve the purchasing power of the capital, while bonds guarantee a real loss at negative existent interest rates.

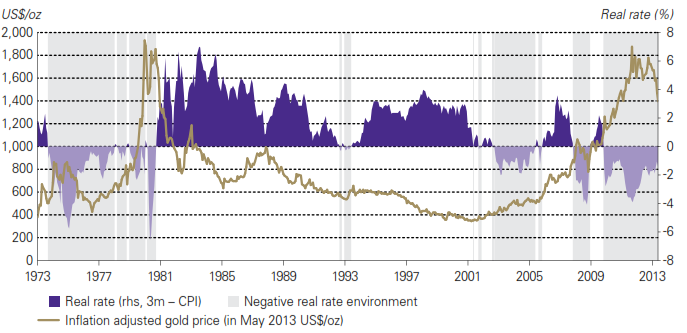

A few historical examples confirm the agin human relationship between existent involvement rates and gold prices. In the 2nd one-half of the 1970s, both nominal interest rates and inflation rates were high. What is important, is that aggrandizement exceeded the nominal returns on bonds, therefore investors shifted their capital into gilded. While existent interest rates were negative, the price of gold rose, reaching its ultimate high. However, equally soon as Paul Volcker hiked short-term nominal interest rates and real involvement rates came back into positive territory, the gold boom ended. Interestingly, the significant downtrend in the gold market connected until 2001, when the Fed, trying to reinflate a stock bubble, cut nominal interest rates and then much that real involvement rates fell to zero. As we tin see in the graph, the consolidation from mid-2006 was caused by the ascension in real interest rates. However, in late 2007 the Fed lowered nominal rates again, and so real rates plummeted and the gold price simultaneously soared.

Chart 1: Real gold prices and real interest rates (equally yields on 3-calendar month Treasury bills less CPI aggrandizement) from 1973 to 2013; source: gold.org)

Summing up, changes in real interest rates are crucial to understanding movements in the price of gold. The adverse relationship between existent interest rates and the aureate price is quite well-established in the literature and was confirmed by a few empirical exercises. The biggest booms in the gold market occurred in negative real rates environments, first during 1970s, when both nominal interest rates and inflation rates were high, and later on in 2000s, when both nominal interest rates and aggrandizement rates were depression.

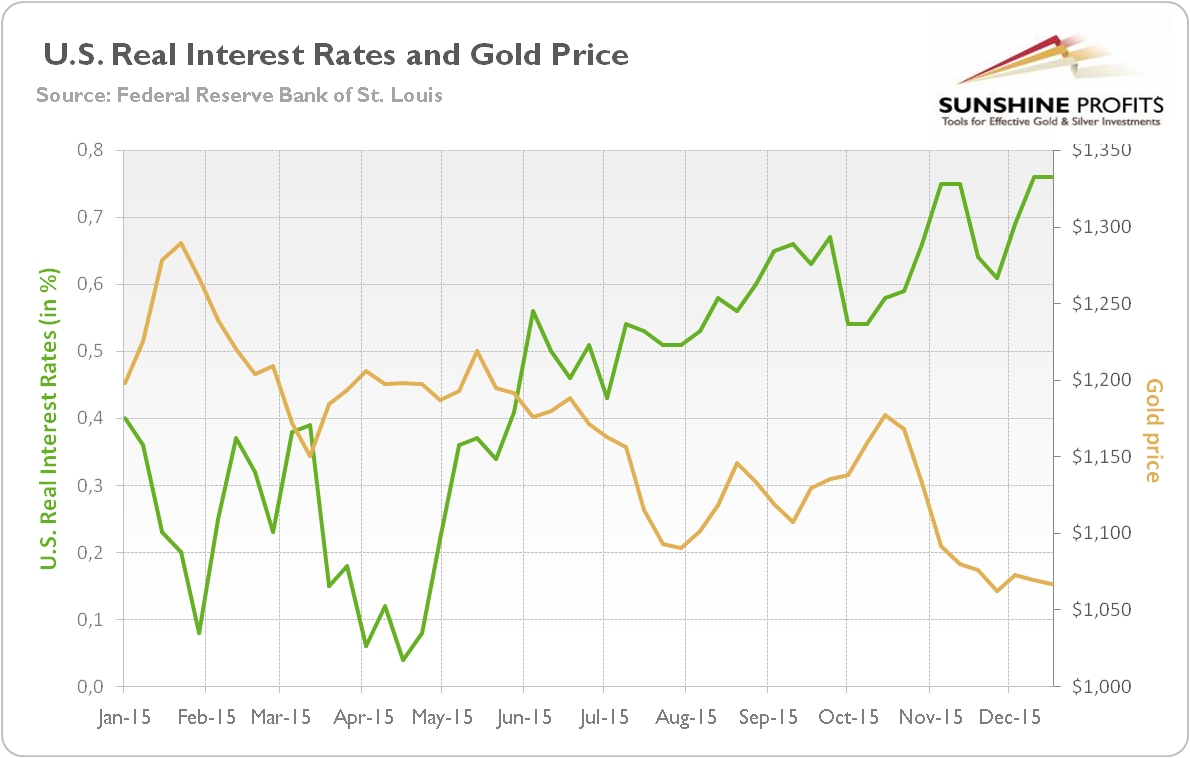

Another example is 2015, when the price of gilt cruel on the expectations of the Fed hike and the resulting appreciation of the U.Due south. dollar against major currencies, and on the rise in the U.Due south. real interest rates (see the nautical chart below).

Nautical chart ii: The price of gold (yellowish line, right axis, London PM Set) and U.S. real involvement rates (light-green line, left axis, yields on 10-year Treasury Inflation-Indexed Security) in 2015.

Negative Real Involvement Rates and Golden

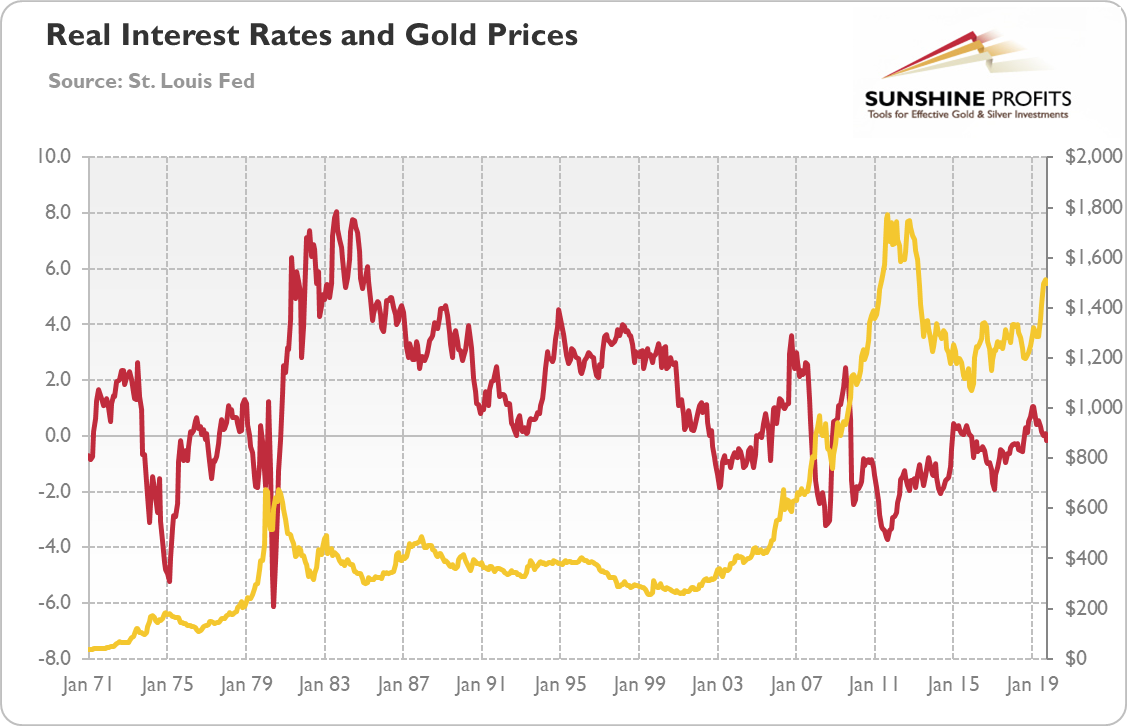

Although gilt can gain when real interest rates are moderately positive, the negative real interest rates are ane of the most of import drivers of the rallies in gold prices. Indeed, allow's look at the chart below, which shows the aureate prices and the short-term real interest rates (1-yr Treasury rate minus the annual CPI rate).

As one tin can run across, the gilt prices rallied in late 1970s and 2000s, when the real interest rates turned negative. Meanwhile, the 1980s and the 1990s were the periods of positive real interest rates, so gold struggled. What is also important to recollect is that it's not merely about the level of involvement rate, but also about the direction or tendency in the real interest rates.

Chart iii: Gilded prices (yellow line, correct centrality, London P.Chiliad. Ready, in $) and real interest rates (as yields on 1-year Treasuries less CPI almanac aggrandizement; red line, left axis, in %) from January 1971 to October 2019)

In 2019, the real interest rates peaked and started downwardly trend. They even fell below zero. And then, it can't be seen every bit a coincidence, that the golden prices jumped in 2019. At the moment of writing these words in mid-November 2019, the real interest rates are venturing deeper into the negative territory, which would work to put more than shine to aureate prices. Conversely, if the real rates turn positive, the yellowish metal may struggle.

We encourage you to acquire more than about gold – not merely how it is affected past real interest rates, but also how to successfully use the shiny metal as an investment and how to profitably trade it. A great way to outset is to sign upward for our gold newsletter today. It's free and if you don't similar it, you tin can hands unsubscribe.

Dorsum

Source: https://www.sunshineprofits.com/gold-silver/dictionary/real-interest-rates-gold/

0 Response to "what is the relation of gold prices to real interest rate"

Post a Comment